You may think you don’t need restaurant insurance if you and your staff are diligent with safety precautions. While some things, like the 7,000 fires that American restaurants experience each year, are preventable, other things, like the COVID-19 pandemic, are out of your hands. When you equip your business with insurance, you can be prepared to handle anything that comes your way.

A combination of restaurant insurance policies can protect you from being sued if an employee gets injured on the job, or if a customer gets hurt on-premise, for example. Insurance also protects your delivery drivers from accidents on the road, and your revenue from an interruption in business if your equipment stops working.

Restaurant insurance is a no brainer because it covers the costs of emergencies big and small, and protects your business. In this guide to restaurant insurance you’ll get the answers to these FAQs and more:

- What is restaurant insurance and why is it important?

- What kind of insurance does a restaurant need?

- How much does restaurant insurance cost?

- What should you know before buying insurance for your restaurant?

What Is Restaurant Insurance?

Restaurant insurance is a policy package that offers financial protection for your business, staff, and customers in the case of fires, accidents, lawsuits, revenue loss, and more. Contrary to popular belief, there is no single insurance policy called “restaurant insurance.” Instead, this phrase refers to bundles of plans that protect restaurants, cafes, bars, and other foodservice establishments from risks they’re likely to encounter.

You can buy restaurant insurance from one provider, or create your own package by combining coverage plans from various providers.

Why Is Restaurant Insurance So Important?

Insurance is a critical operating cost for restaurants and other small businesses. Restaurants need insurance for a number of reasons:

1. It Protects Your Money

You may not be able to pay out of pocket to repair damage to your restaurant caused by a fire, or to pay staff if a natural disaster causes an interruption in business. Insurance can help you pay for repairs and recoup lost revenue, so you don’t have to deplete your life’s savings or file for bankruptcy to save your business.

2. It Helps You Protect Your Staff

Workers’ comp insurance, for example, gives employees who get injured on the job money for their medical expenses. It also protects you from being sued.

3. It Protects Your Customers

If a customer falls on-premise, for example, your insurance would cover their medical expenses.

Even with great care taken to minimize safety hazards at a restaurant, there are so many unpredictable factors that can’t be controlled. Restaurant insurance doesn’t minimize these risks, but it can help minimize the damage caused by a variety of bad situations.

What Kind of Insurance Does a Restaurant Need?

Restaurant insurance isn’t one type of insurance policy, but rather, a combination of several policies that cover a variety of liabilities.

So, what kind of insurance does a restaurant need? These are the types of coverage every restaurant – even very small operations – should consider:

- General Liability Insurance: General liability insurance is a broad policy that covers a variety of things like damage to customer property, copyright infringement, and customer injuries. For example, this type of policy would protect you if a painting falls off of a wall at your restaurant and injures a customer. This coverage would pay for the customer’s medical expenses and your legal expenses if the customer sues.

- Commercial Property Insurance: This policy protects your rented or owned space from named perils like vandalism, theft, fire, and wind damage. Your insurance premium will cost much less than any damage you might have to pay for out-of-pocket, should something like this occur. Most landlords won’t let you rent a space without proof of commercial property insurance. However, it’s important to note that commercial property insurance doesn’t cover natural disasters, so ask your insurance agent about adding that to your policy if you live in an area prone to such events.

- Workers’ Compensation Insurance: Workers’ comp covers medical care for staff injured on the job, and protects your business from being sued by injured employees. This insurance is mandatory in almost every U.S. state. In Canada, regulations for workers’ comp are set by provincial governments. Check your local laws to find out whether it’s mandatory for your business.

- Commercial Auto Insurance: If your restaurant employs food delivery drivers, you’ll need to cover your drivers with commercial auto insurance. Personal vehicle insurance isn’t enough in this case. Commercial auto insurance covers damage, medical payments, and more in case of accidents. However, if your restaurant uses delivery drivers through third-party delivery companies like DoorDash, you’re not responsible for providing them with this insurance.

- Liquor Liability Insurance: Your business might be liable for injuries caused by your restaurant’s intoxicated patrons. Get liquor liability insurance as an add-on to your general liability insurance to protect your business from the actions of inebriated customers.

- Business Interruption Insurance: This policy helps replace revenue lost to interruptions in business caused by natural disasters and fires. Business interruption insurance also pays for relocation expenses and payroll costs.

- Equipment Breakdown Insurance: This type of restaurant insurance pays for repairs and lost income caused by the breakdown of major pieces of equipment. For example, if your stove breaks down and your restaurant has to close for a week until it’s fixed, this policy would cover the revenue you lost during that week.

Keep in mind that not every restaurant will need all of the policies listed above. As a result, the best strategy is to combine the policies you do need to create the perfect restaurant insurance bundle for your business.

How Much Does Restaurant Insurance Cost?

Many factors affect restaurant insurance costs. The riskier your restaurant, the more expensive your premiums will be. A premium is how much you pay, usually on a monthly basis, for your insurance policy.

For example, a restaurant with no stoves, like an ice cream parlor, may have lower insurance premiums than a restaurant with stoves because of a reduced risk of a fire breaking out. However, a bar that doesn’t serve food and doesn’t have a stove may have higher insurance costs because of its liquor liability.

These are the major factors that insurance companies take into account when creating estimates for restaurant insurance costs, so make sure to have this information handy as you shop for a quote:

- Your restaurant’s location: A restaurant in a dangerous neighborhood may be more at risk of damage and theft, whereas a restaurant in a safe neighborhood may cost less to insure.

- The type of property: This question is most pertinent to commercial property insurance. The type of building your restaurant is located in can determine your risk.

- Years in business: The longer you’ve been in business without claims, the lower your premiums will be.

- Revenue: Showing a track record of revenue growth could make your business less risky to cover than a restaurant that’s just getting off the ground.

- Equipment information: What types of equipment do you have in your restaurant and how much are each of those pieces worth?

- Number of policies needed: If you need multiple policies, you may be able to bundle them and receive discounted pricing.

- Amount of coverage needed: Do you want to be covered for $500,000 or $5 million? The more coverage needed, the higher your premium.

- Employee information: How many employees do you have and what are their roles?

- Prior claims history: If you’ve made claims that have resulted in high payouts by past insurance providers, you’ll probably encounter higher-than-average premiums.

Having these details on hand will help you get accurate restaurant insurance quotes quickly.

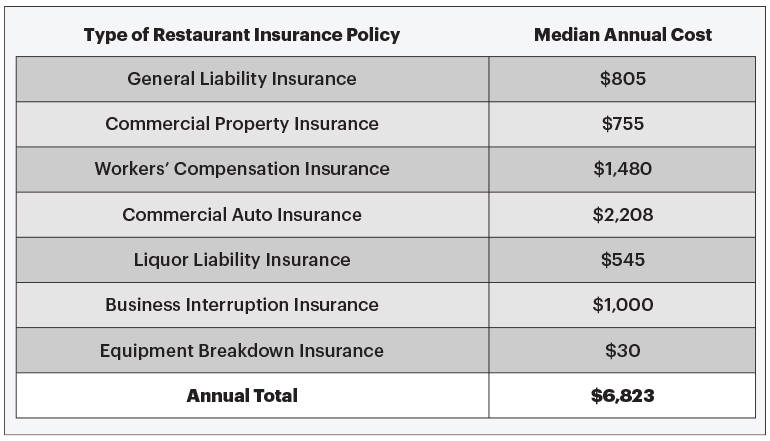

Typical Restaurant Insurance Costs

Here’s a look at the median annual cost of each type of restaurant insurance you need:

While the table above provides you with a good estimate of your annual insurance costs, keep in mind that these are median figures provided by various insurance companies and that your own restaurant insurance costs will vary based on the factors outlined in the previous section. Also note that you’ll pay monthly premiums, which are more conducive to successful cash flow management than annual payments.

And while the cost of insurance may seem high, just think about what it would cost to pay for an injured employee’s medical expenses, buy a delivery driver a new car, or rebuild your restaurant if it burned down. When you put it into perspective, several thousand dollars in annual insurance premiums is a small chunk of change compared to paying out of pocket for these kinds of emergency expenses.

4 Things You Need to Know Before Buying Restaurant Insurance

Consider these insider tips before buying your restaurant insurance policies.

1. Only Buy the Coverage You Need

Not all of the policies outlined above apply to every restaurant owner. For example, if you don’t employ delivery drivers, then you won’t need commercial auto insurance, and if you don’t serve alcohol, you won’t need liquor liability insurance.

Do your research to make sure you’re buying only what you need. Insurance agents can also help you figure out whether or not their policies are applicable to your business.

If a policy is relevant to you, but you’re not sure if you should pay for it, consider whether the annual premium costs are cheaper than covering the costs of whatever might happen out of pocket. More often than not, investing in coverage makes more financial sense than not buying into it.

2. You Might Need Multiple Policies

As you know, there’s no such thing as a catch-all restaurant insurance policy. Instead, you have to build a restaurant insurance package out of multiple policies. And while you might be able to get a good deal on the half dozen policies you’ll need from one insurance provider, it doesn’t hurt to compare quotes and even buy policies from several providers.

Shop around until you find the policies that give you the best coverage for the best price. If you don’t know where to start, ask fellow restaurateurs about their insurance providers. Carefully examine bundles to make sure you need everything you’re paying for.

3. Try a Business Owner’s Policy (BOP)

A business owner’s policy (BOP) is a type of insurance that combines several critical coverages into a single policy. Most BOPs combine general liability, commercial property, and business interruption insurance, and are usually cheaper bundled than a la carte.

4. Consider Your Deductible Carefully

A deductible is how much you have to pay out of pocket for damages and other costs before the insurance kicks in and covers the rest. A restaurant insurance policy with a $50,000 deductible means that even though you’re paying a premium (your monthly investment to be insured), you’re responsible for paying the first $50,000 of otherwise covered costs before your insurance kicks in and pays for the rest. A policy with no deductible, on the other hand, will cost you nothing besides your premium.

Deductibles can be costly and surprising. Make sure to ask about deductibles before you buy your restaurant insurance policies. Often, the lower the deductible, the more expensive the monthly premium, and the lower the premium, the higher the deductible. Having no deductible is ideal – as long as it’s affordable. Weigh the costs of the deductible against the cost of the premium and the risk that you’ll actually need to use the policy.

Wrapping Up: What You Need to Know About Restaurant Insurance

To sum up, restaurant insurance is the name for a bundle of insurance policies that cover financial risks that restaurants and other foodservice establishments face. These bundles may include general liability, commercial property, workers’ compensation, commercial auto, liquor liability, business interruption, and equipment breakdown insurance plans.

When shopping for policies, make sure to get only what you need, consider your deductible, and ask about discounts on BOP bundles. While you will hopefully never have to use your restaurant insurance, having it will give you peace of mind knowing that if something were to happen, your business, staff, and customers would be protected from any restaurant cyber security risks.

Download our free inventory template

Sign up for our free weekly TouchBistro Newsletter