Summary

Minimum wage rose in New York, California, Florida, Michigan, and other 14 states in January 2018. So we set out to answer a couple of questions: How will restaurants be affected by rising minimum wage? How are restaurants dealing with the increase in labor costs? Now that restaurants have been dealing with the change for a few months, we were able to collect data from restaurant owners in all affected states and present it to you – the restaurant owner who’s wondering how higher minimum wage will affect their business.

The State of Minimum Wage in the United States

Your people are the heart and soul of your business.

But great people can sometimes come at a great cost. For most restaurants, labor takes up about 30% of their annual expenses. And as much as you’d love to pay your staff more than minimum wage, that’s sometimes just not possible when you’re operating at a 4% profit margin.

In the United States, the federal minimum hourly wage of $7.25 has remained unchanged since 2009. But hourly wages in cities and states continue to rise. On January 1, 2018, 18 states in the U.S. increased their hourly minimum wage.

…and more increases are scheduled for later in 2018 for other states.

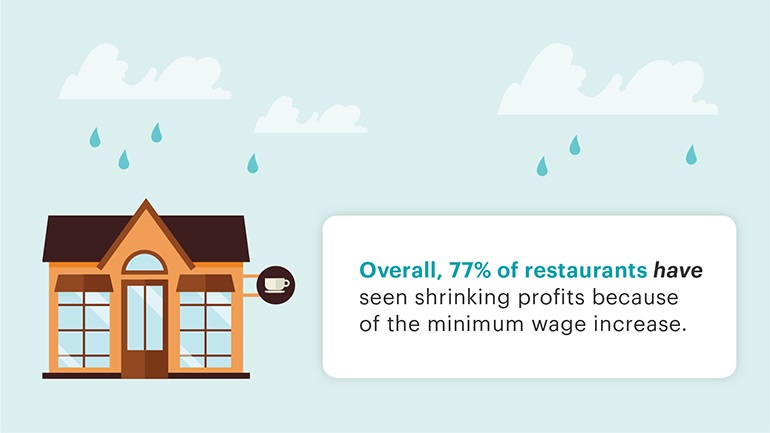

As a restaurant owner, labor is one of your most substantial expenses. Rising wages will lead to an increase in these costs, which will cause shrinking profits in the short term. And the more staff you have, the more pain you’ll feel.

So the impact is clear: rising minimum wage will require you to take a breath, strategize, and adapt.

That’s why we put together this research report – to uncover the true effects of increasing minimum wage on restaurants. We also surveyed restaurant staff who are on the receiving end of these staffing changes, so you’re better informed of their experiences before you make changes to your own operations.

Fast Facts About Rising Minimum Wage

- Profits are shrinking the most in California because of minimum wage increases

- Profits are shrinking the least for bars and coffee shops

- Profits are shrinking more for restaurants that have a labor ratio of 31%–35%

The Effects of Rising Minimum Wage on Restaurants

Of restaurant owners surveyed for this report, 77% have seen shrinking profits because of the minimum wage increase.

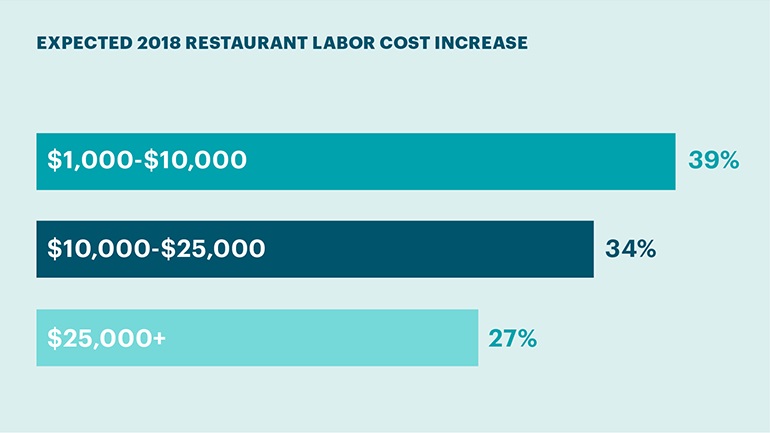

But it’s not all bad news. Most restaurant owners will see a labor cost increase of $1,000– $10,000 in 2018, which is a hit they can deal with.

For restaurants anticipating a $1,000–$10,000 raise in labor costs:

- 45% say their profits haven’t shrunk

- 81% have not reduced staff

- 61% have not raised menu prices

So as it turns out, restaurants can take a small hit. But what if your profits are shrinking and you want to stop the bleeding? Turns out there are three main ways restaurants are dealing with increasing labor costs.

How Restaurants Are Coping with Rising Minimum Wage

We asked owners: how are you cutting costs to make up the difference? There are three ways:

- Raising menu prices

- Cutting operating hours

- Letting go of staff

Here’s where owners stood on these three coping mechanisms:

If owners have seen shrinking profits, the majority of them are raising menu prices and cutting operating hours.

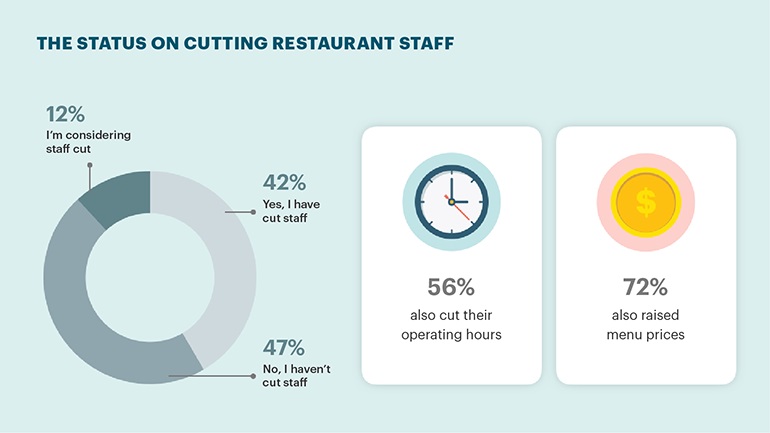

Meanwhile, all restaurant owners who have seen shrinking profits have or are considering cutting staff.

The data is a little different when we’re talking to restaurant owners who haven’t necessarily seen shrinking profits. Here’s where all survey participants stood on cutting staff:

As a whole, restaurant owners seem so much more comfortable with raising menu prices.

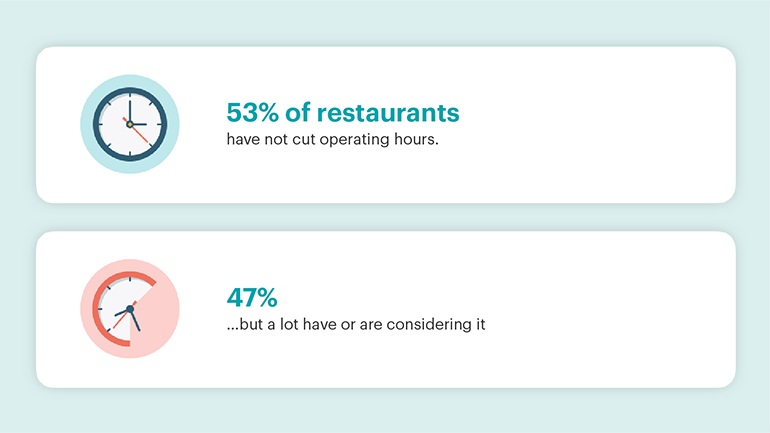

Restaurant owners are a lot less comfortable with reducing operating hours, but they’re warming to the idea.

How Restaurant Technology Can Help with Cutting Labor Costs

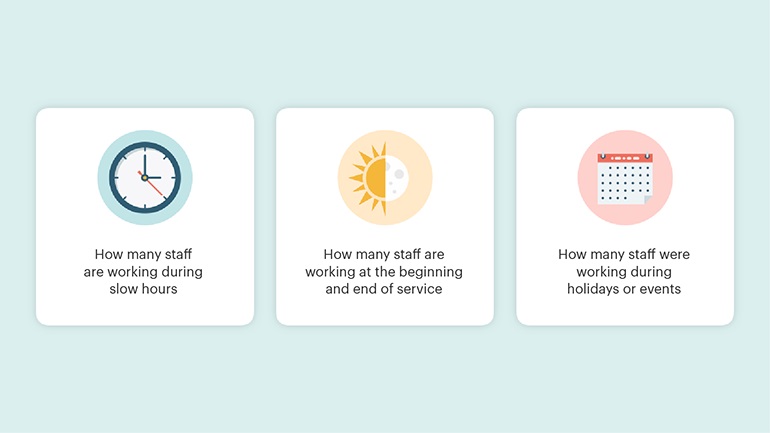

Our research results show that a lot of restaurant owners (39%) are not using their POS to view labor reports. Restaurateurs who don’t use data to make scheduling decisions are missing out on some efficiencies that could save them significant costs.

Your POS can and should be your money-saving hub. Restaurant owners are able to save on some costs immediately once they know:

Here are some ways your POS can help you cut labor costs – without firing your staff.

Cut staff during slow periods.

Depending on how involved you are in staff scheduling, your manager may be scheduling too many employees during slow times – and you may not even know it. Review your labor reports on your POS to gain some visibility into when staff are being cut, so you can correct your manager if you need to.

Save in small ways that build up over time.

Cut back on the number of staff you schedule at 5:00 pm, when everyone is just starting dinner and only ordering drinks. Scheduling the bulk of your dinner staff just an hour later can save on labor costs in the long run.

Check your labor reports from last year.

Check against seasons, holidays, times of days, etc. to make sure you schedule the exact amount of staff when you need them – and not when you don’t. You may have overprojected your staffing needs during last year’s Super Bowl event, and your labor report from that time can remind you not to schedule as many bartenders this year.

The rising minimum wage will continue over the coming years, and the immediate impact on your business may cause some pain. But the long-term impact doesn’t have to lead to shrinking margins and closure. You just have to plan and take a strategic approach to remain profitable.

At TouchBistro, we’re committed to helping thousands of restaurateurs across the world run better businesses. Our products, services, and resources exist to enable, educate, and nurture restaurateurs and the businesses they hold dear.

This study was conducted by Maru Matchbox research firm on behalf of TouchBistro.

Results are from 200 Americans living in 18 states affected by minimum wage as of January 2018. The survey was conducted in March/April 2018.

Download your free employee handbook template

Sign up for our free weekly TouchBistro Newsletter