2025 Chicago State of Restaurants Report

Explore the top challenges, biggest opportunities, and must-know trends for independent restaurants in Chicago.

Download the

Report Highlights

of operators in Chicago have not raised menu prices in the past 6 months

use their marketing channels to send personalized offers (up from 57% in 2023)

have seen their takeout/delivery sales increase compared to last year

2025 CHICAGO STATE OF RESTAURANTS REPORT

Dive Into the Latest Chicago Restaurant Trends

In light of high inflation and another tipped minimum wage increase, Chicago restaurant trends have evolved in interesting ways over the past year. To gain a better understanding of what trends and challenges Chicago operators are experiencing, we recently surveyed independent, full service restaurant operators from across Chicago. This survey was part of our larger 2025 State of Restaurants Report, where we surveyed over 600 full service restaurants to gather the latest restaurant trends across the U.S.

Continue reading for a sneak peek at the top restaurant trends in Chicago, including the latest data on staffing, marketing, technology, and more. For a complete picture of the state of the restaurant trends in Chicago, download our free 2025 Chicago Restaurant Trends Report.

Food & Inventory Costs are Chicago Restaurants’ Top Financial Strain

Like their peers across the country, independent operators in Chicago continue to feel the weight of rising food costs. In fact, Chicago operators cite food costs as the number one obstacle to growing their businesses right now, alongside attracting new customers. Our Chicago restaurants report also found that a quarter (25%) of operators in Chicago reported that rent was their number one source of financial strain – a greater proportion than in any other U.S. city and an added expense on top of rising inventory costs.

Download the reportGreatest Causes of Financial Strain in the Past 12 Months for Chicago Operators

47% of Operators Report Labor Costs as the #1 Staffing & Challenge

The costs of just about everything have gone up for Chicago operators, including labor. 47% of operators in Chicago reported overall labor costs have been the biggest staffing and labor challenge they’ve faced this past year, which may be partially fueled by ongoing tipped minimum wage increases. This decision may have also played a role in operators’ struggle to retain talent, which an equal number of operators indicated as one of their primary staffing and labor challenges.

Download the reportBiggest Staffing/Labor Challenges in Chicago

Overall labor costs

Staff turnover (trouble retaining staff)

Minimum wage increases

Scheduling challenges

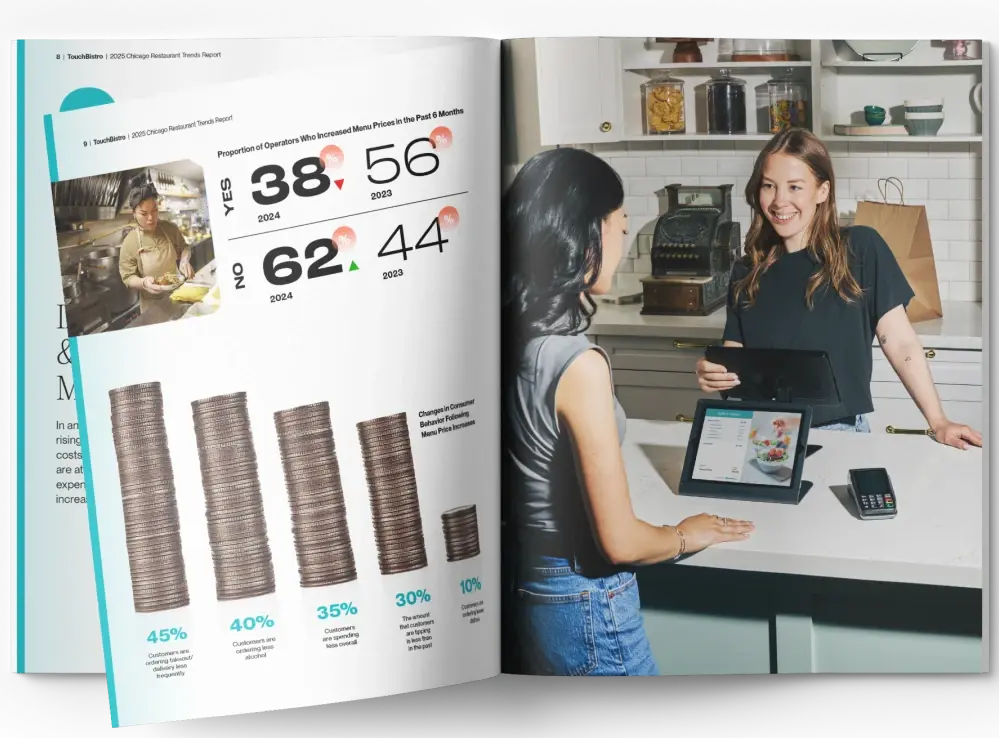

Majority of Chicago Operators No Longer Favor Menu Price Hikes

Unlike last year, menu price hikes are no longer the go-to strategy for combating higher costs among the majority of Chicago operators. In fact, 62% of Chicago operators now report having not raised their menu prices in the past six months. And among those who did increase their menu prices, 45% reported customers were ordering takeout/delivery less frequently and 40% observed customers ordering less alcohol. This signals that Chicago diners have a lower tolerance for menu price increases and operators are now well aware of the problems that can stem from constant price hikes.

Download the reportChanges in Consumer Behavior Following Menu Price Increases

Chicago Operators Experience a Surge in Takeout & Delivery Sales

One of the more interesting Chicago restaurants stats uncovered by our report is that, in the past year, a whopping 85% of operators in Chicago indicated that their takeout/delivery sales have either significantly or slightly increased from the year prior. This signals that, despite high levels of inflation and an increased cost of living, diners are still willing to spend money on takeout and delivery. Plus, 49% of Chicago operators report adding more off-premise ordering options as a strategy to increase revenue, which suggests they see this channel as one worth continuing to invest in.

Download the reportChange in Takeout/Delivery Sales Compared to Last Year

Significantly increased

Slightly increased

Remained the same

Slightly decreased

Significantly decreased

TikTok Usage Among Chicago Restaurateurs Nearly Doubles from Last Year

Last year, only 33% of Chicago operators used TikTok to promote their restaurant. Fast forward to today and that percentage has nearly doubled to 62%, proving that TikTok may soon take the lead as one of the most popular platforms for Chicago operators to promote their venues.

Download the reportSocial Media Platform Used by Chicago Restaurants

Automation is Taking Off in Chicago Restaurants

One of the newer Chicago restaurant trends is that operators have picked up significant momentum when it comes to implementing automation. For instance, 70% of Chicago operators have now automated online ordering, which is far higher than the U.S. average of 57%. And as a result of automating this and other tasks, such as email marketing and invoicing, Chicago operators are reaping the benefits. In fact, 49% of operators who had automated everyday tasks in their restaurant reported more productive staff and 47% have experienced business growth.

Download the reportTop Benefits of Restaurant Automation for Chicago Operators

More productive staff

Business growth

Faster service

Methodology

We partnered with research firm Maru/Matchbox again this year to survey more than 600 full service restaurant owners, presidents, and area/general managers across all 50 states, with an added focus on eight key cities: New York City, Los Angeles, Chicago, Dallas, Houston, Austin, Denver, and Las Vegas. Our research was conducted from June 27 to July 15, 2024. The statistically significant survey results are accurate 19 times out of 20.

Explore TouchBistro

Need help navigating the latest trends?

TouchBistro’s all-in-one restaurant management system is equipped with all the front of house, back of house, and guest engagement solutions you need to run and grow your business.

See PricingFront of House

Deliver the speed and quality of service that guests expect.

Back of House

Control costs and run your kitchen more efficiently.

Guest Engagement

Engage guests in-venue and online to keep them coming back for more.

Success! Click below to access the download.

We’ve also sent you a confirmation email with a personal download link so you can access the content at any time.

download now